[ad_1]

The new FTP has introduced a one-time amnesty scheme for exporters to close the old pending authorisations and start afresh.

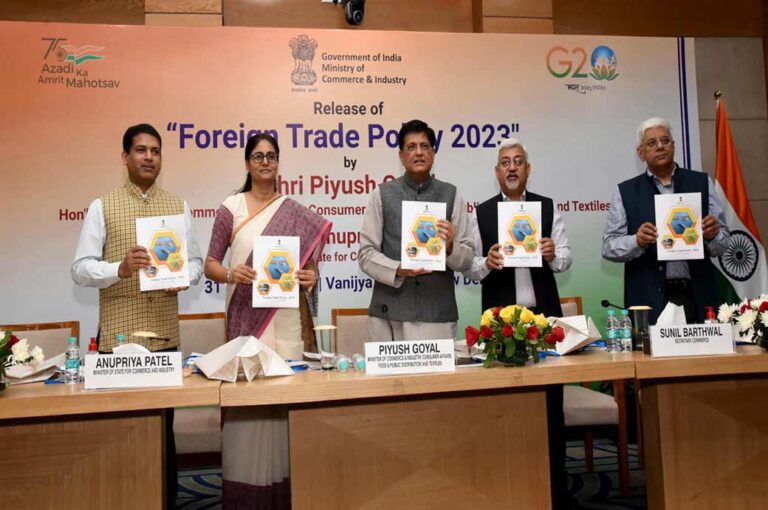

India’s Foreign Trace Policy 2023 announced today aims at process reengineering and automation to facilitate ease of doing business for exporters and facilitating e-commerce export, and collaborating with states and districts to promote exports.

Reduction in fee structures and IT-based schemes will make it easier for MSMEs to access export benefits.

It also focuses on emerging areas like dual use high-end technology items under Export of Special Chemicals, Organisms, Materials, Equipment and Technologies (SCOMET).

Reduction in fee structures and Information technology (IT)-based schemes will make it easier for micro, small and medium enterprises (MSMEs) to access export benefits.

The target is to treble foreign trade in the next seven years and boost exports to $2 trillion by 2030. The government estimates total exports worth $760-770 billion during fiscal 2022-23, which ends today. The country has shifted its policy of promotion from incentives to a remission- and entitlement-based regime.

The new policy encourages recognition of new towns through the ‘Towns of Export Excellence’ (TEE) scheme and exporters through ‘Status Holder Scheme’. It has also streamlined the popular Advance Authorisation and Export Promotion of Capital Goods (EPCG) schemes.

Four new towns—Faridabad, Mirzapur, Moradabad and Varanasi—have been designated as TEE in addition to the existing 39. The TEEs will have priority access to export promotion funds under the Market Access Initiative (MAI) scheme and will be able to avail common service provider benefits for export fulfillment under the EPCG scheme. This addition is expected to boost the exports of handlooms, handicrafts, and carpets, an official release said.

Duty exemption schemes for export production will now be implemented through regional offices in a rule-based IT environment, eliminating the need for manual interface.

Various estimates suggest the country’s e-commerce export potential will be in the range $200-$300 billion by 2030. The new policy outlines the intent and road map for establishing e-commerce hubs and related elements like payment reconciliation, book-keeping, returns policy and export entitlements.

As a starting point, the consignment wise cap on e-commerce exports through courier has been raised from ₹5 lakh to ₹10 lakh. Depending on the feedback of exporters, this cap will be further revised or eventually removed.

Integration of courier and postal exports with the Indian Customs Electronic Data Interchange gateway (ICEGATE) will enable exporters to claim benefits under the new policy.

The comprehensive e-commerce policy addressing the export/import ecosystem would be elaborated soon, based on the recommendations of the working committee on e-commerce exports and inter-ministerial deliberations, the minister said.

Merchanting trade of restricted and prohibited items under export policy would now be possible. Merchanting trade involves shipment of goods from one foreign country to another foreign country without touching Indian ports, involving an Indian intermediary.

The new policy introduces a special one-time amnesty scheme to address default on export obligations. It will offer relief to exporters who have been unable to meet their obligations under EPCG and advance authorisations, and who are burdened by high duty and interest costs associated with pending cases.

All pending cases of the default in meeting export obligation of authorisations mentioned can be regularised on payment of all customs duties that were exempted in proportion to unfulfilled export obligation.

Fibre2Fashion News Desk (DS)

[ad_2]

Source link